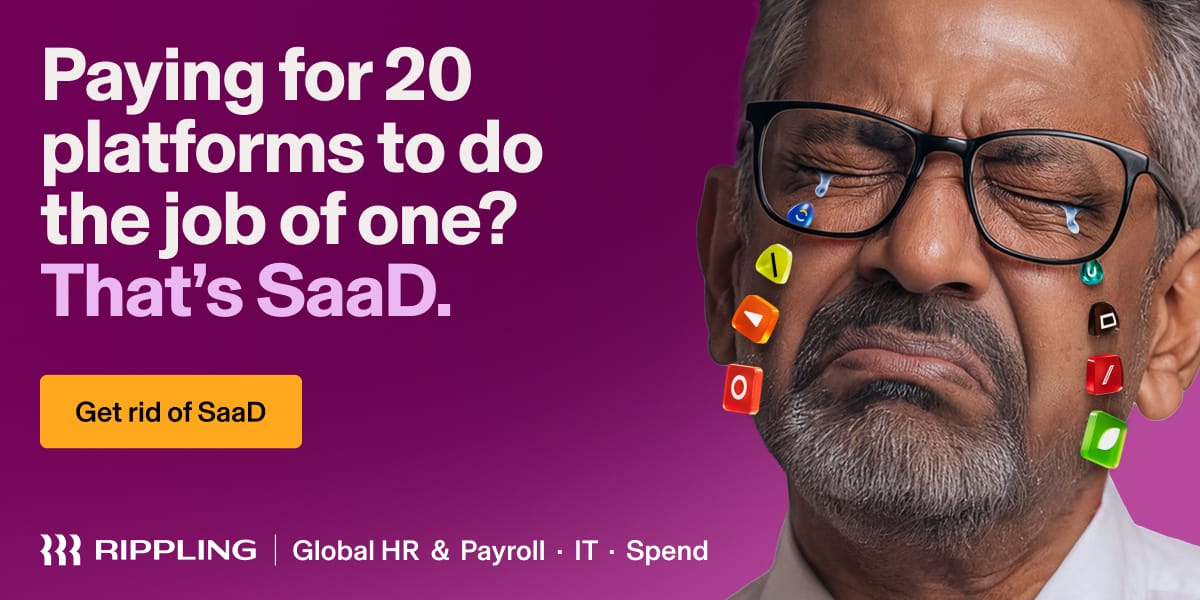

Don’t get SaaD. Get Rippling.

Remember when software made business simpler?

Today, the average company runs 100+ apps—each with its own logins, data, and headaches. HR can’t find employee info. IT fights security blind spots. Finance reconciles numbers instead of planning growth.

Our State of Software Sprawl report reveals the true cost of “Software as a Disservice” (SaaD)—and how much time, money, and sanity it’s draining from your teams.

The future of work is unified. Don’t get SaaD. Get Rippling.

Hey there, CFOs! 💼

CFOs are evolving from cost guardians to growth catalysts. Customer value and AI-powered insights now shape financial decisions and investment priorities.

Are your metrics built around control or connection?

📰 Upcoming in this issue

🧭 What It Means to Be a Customer-Centric CFO

🤖 AI Transforms CFOs into Strategic Growth Leaders

💡 IBM CFO Sees Tailwinds from Hyperscalers’ AI Buildout

📈 Trending news

CFO–CIO Unity Wins AI Bets

Make AI Your Fintech Growth Engine

Where Fintech Growth Will Come From

🧭 What It Means to Be a Customer-Centric CFO

Finance leaders are linking margin goals to customer outcomes, not just cost controls. This article explains how CFOs embed LTV, retention, and experience into decision-making.

Key Takeaways:

📊 Metrics That Matter: Tie budgets to LTV, churn, and payback, then report them alongside margin and cash to align the organization around customers.

🤝 Cross-Functional Rhythm: Partner with product, sales, and CX on pricing, packaging, and support, translating tradeoffs into clear financial impact.

🧱 Data Foundations: Unify billing, product usage, and support data to model cohorts, forecast retention, and guide resource allocation.

🎯 Investment Lens: Prioritize programs that build loyalty and drive expansion, funding experiments with stage gates, benchmarks, and accountable owners.

🤖 AI Transforms CFOs into Strategic Growth Leaders

AI is shifting finance from compliance to value creation, with CFOs now steering data, automation, and decisions that accelerate revenue. This article outlines the new mandates, roadmaps, and watchouts.

Key Takeaways:

📊 Mandate Expansion: CFOs now lead growth strategy, aligning AI investments with revenue, retention, and margin while maintaining financial stewardship.

🧱 Data Foundations: Clean, governed data unlocks forecasting, pricing, and working capital gains that compound across functions.

⚙️ Operational Automation: Close, cash application, and anomaly detection are automated reliably, freeing finance for analysis and planning.

🧭 Governance and Talent: Strong guardrails, auditability, and analytics upskilling build trust and enable scale without losing control.

💡 IBM CFO Sees Tailwinds from Hyperscalers’ AI Buildout

Rising AI capacity among cloud giants is boosting demand for IBM’s hybrid software and infrastructure. The CFO highlights how partners and Watsonx are converting that demand into revenue..

Key Takeaways:

🤝 Partner Momentum: Deeper collaboration with hyperscalers channels AI projects to IBM Consulting, Red Hat OpenShift, and data platforms.

🧠 Watsonx Pull: Enterprise AI adoption is converting pilots into paid deployments, reinforcing IBM’s focus on governed, hybrid use cases.

🖥️ Infra Lift: AI workloads are driving demand for IBM servers, storage, and automation, supporting upgrades across hybrid environments.

📈 Financial Framing: The CFO notes improved pipeline quality and disciplined margins, combining selective investment with clearer AI-driven bookings.

📊 Take This Edition’s Poll:

Would you rather lead with control or with connection?

Why It Matters

Customer-centric finance connects margin to experience, fueling durable revenue growth. Start by unifying data and aligning forecasts with retention and LTV.

Governance, automation, and AI-driven visibility make strategy measurable, repeatable, and scalable.

Wishing you continued success,

Vanessa Carter

Editor-in-Chief

CFO Executive Insights

P.S. Interested in sponsoring a future issue? Just reply to this email and I’ll send packages!